The road to mortgage approval is often paved with paperwork.

Mortgage lenders have specific guidelines and requirements that must be met for loan approval. Sending the correct documents ensures that you are in compliance with these standards, which can vary depending on the lender, loan program, and your financial situation. Failing to provide the right documents may result in delays, denials, or even higher interest rates, as lenders rely on these documents to assess your creditworthiness and ability to repay the loan.

To avoid delays, rejections, and unnecessary stress, take the time to carefully gather and submit all required documents accurately. It is important to note that a mortgage broker cannot submit a mortgage application without the mandatory documents. This also means that we will not be able to secure your mortgage rate. Additionally, the lender will not start to underwrite your application without the requested documents.

Please do not send screen shots, this is not a valid document.

Personal ID – Passport / Driving Licence

A current UK photocard driving license can be used, with both the license and photo displaying your current address.

Alternatively, you can provide a valid and signed UK/Irish passport.

Please be aware that the lender will not consider a photograph as valid identification, it must be sent as a scanned copy.

If you don’t possess a passport or driving license, rest assured we will explore alternative identification options.

Address ID

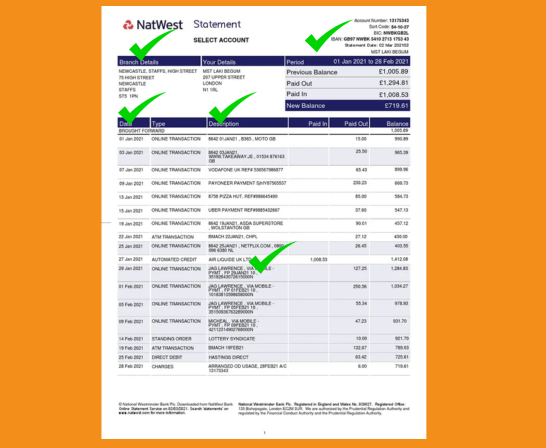

The majority of customers typically provide a recent bank, building society, or credit card statement. The statement should be dated no more than one month ago.

Many lenders accept an annual council tax bill or demand letter, as long as it’s no older than 12 months.

Ensure that you send in all pages of the document. For instance, if you are submitting a four-page bank statement, we will need all four pages.

Please refrain from sending a transaction statement, as it lacks essential information such as your name, bank logo, address, or the bank’s address.

4 months latest bank statements

You must provide four months’ worth of bank statements for all your active accounts. If you are self-employed, you’ll also need to include four months of business bank statements.

Even if you haven’t used an account, you still need to submit the most recent four months’ worth of bank statements.

For instance, if your bank statements are typically generated on the 15th of each month, and today is September 10th, 2023, we will need statements from the following dates:

May 15, 2023

June 15, 2023

July 15, 2023

August 15, 2023

Payslips Employment (not Ltd Co Directors)

You are required to provide your most recent 4 months‘ worth of payslips along with your latest P60.

For individuals who receive weekly payments, we will need your most recent 14 payslips in addition to your latest P60.

If you have received a salary increase within the last 6 months, please include a confirmation letter verifying the pay raise.

In case you have recently commenced a new job within the last 6 months, we will need your final payslip from your previous position and a signed copy of your current employment contract.

If you are currently on maternity leave, please submit your payslip from before you began your leave along with a return-to-work letter.

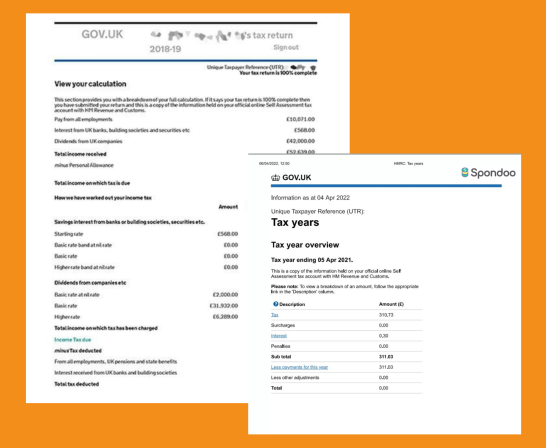

Self-Employment including Limited Company Directors with 10%+shareholding.

You are required to furnish bank statements covering the last four months for all your currently active accounts. If you are self-employed, it is essential to include four months’ worth of business bank statements as well.

Additionally, please provide the following financial documentation:

The most recent three years’ business accounts, or

The most recent three years’ tax computations (or HMRC SA302 forms) along with corresponding Tax Year Overviews.

Ensure that you include the contact details of your accountant, including their name, company, and contact information.

If your company has been in operation for less than three years, please provide financial documentation for the period spanning up to the most recent three years.

Copy of your credit file – Check My File

Our objective is to identify any potential issues within your credit file. Additionally, we endeavor to uncover any unintentionally undisclosed credit commitments, as failing to disclose them could result in unfavorable consequences such as being added to a credit blacklist or encountering difficulties with loan approvals and affordability assessments.

It’s important to highlight that there have been numerous instances where financial institutions have erroneously reported overdue payments, missed payments, or even defaults on individuals’ credit histories.

If you are already using Experian or Equifax, we are pleased to accept a PDF copy. However, we highly recommend utilizing the Check My File service.

As a partner of Check My File, Look After My Mortgage provides a specific link for you to access and review your credit report. Please use this dedicated link for a comprehensive assessment of your credit history.

Buy to Let (Remortgage)

When considering a remortgage for a buy-to-let property, the lender may conduct an evaluation of your employment situation and your plans for addressing rental voids.

The lender typically requires the following documents:

- The most recent three years’ tax computations (or HMRC SA302 forms) along with the corresponding Tax Year Overviews.

- Tenancy Agreements (AST) or estate agent statements.

- Bank statements demonstrating the incoming rental income.

If you own multiple properties, we recommend having your mortgage statements readily available, as the lender may require additional information about your property portfolio.

Outgoings – statements

The lender aims to obtain a precise overview of your financial obligations, including loans, mortgages, secured loans, and unsecured loans (such as personal loans, car finance like HP and PCP).

Please make sure you have the following documents readily available:

All loan agreements.

The most recent credit card statements.

All mortgage statements.

Deposit

Legal Obligations: Solicitors, brokers, and lenders are legally obligated to validate the origin of funds in property transactions to prevent money laundering and fraud. By confirming the source of your deposit, they ensure that the funds used for the purchase have a legitimate and legal source.

Please ensure you can substantiate your deposit with statements from the last three months. In cases where the deposit is a gift, we will need a gifted deposit letter as proof. If your deposit is held within a Help to Buy ISA, we require the most recent annual statement along with the latest transaction statement.

Life, Critical, PMI and Buildings Insurance documents.

The lender aims to obtain a precise overview of your financial obligations, including loans, mortgages, secured loans, and unsecured loans but also your ability to pay rebuild the property, redeem the mortgage in the event of death or illness.

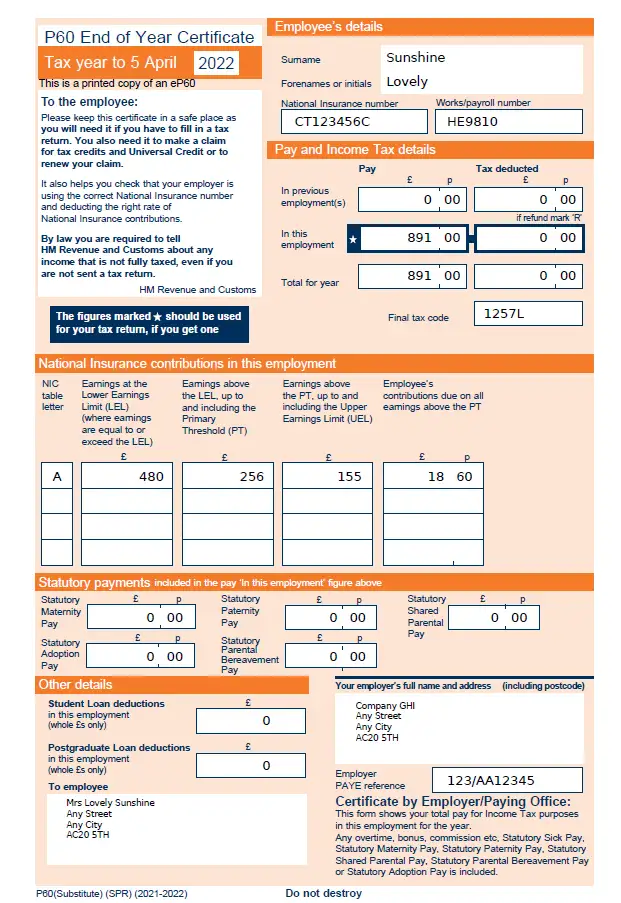

P60

A P60 is an essential document for mortgage applications as it serves as proof of income and tax contributions for the previous tax year. Lenders typically require a P60 to verify an applicant’s financial stability and ensure that they have a consistent income stream. This document helps in assessing the applicant’s ability to meet mortgage repayments by providing a comprehensive overview of their earnings and tax deductions. Including a P60 in your mortgage application can expedite the approval process and enhance your credibility with lenders, making it a crucial component for securing a mortgage.

However, do not worry if you do not have a P60, you may have started a job after the tax year end.

Home Insurance – schedule

A buildings insurance policy schedule is a crucial document that mortgage brokers require during the mortgage application process. This document provides detailed information about the insurance coverage on the property, ensuring that it is adequately protected against potential risks such as fire, flood, or structural damage.

I do not have a scanner, what should I do?

If you don’t have access to a scanner, there are several alternatives you can consider to provide the necessary documents to a lender or organization:

Use a Mobile Scanner App: Many smartphones have apps that can scan documents using the phone’s camera. Popular options include Adobe Scan, Microsoft Office Lens, and CamScanner. These apps can convert photos of your documents into PDFs that you can send electronically.

You use the app like you would to take a photo. You can simply take clear and well-lit scan of your documents using your smartphone’s camera. Ensure that the entire document is visible, legible, and in focus. Save these photos and send them as PDF attachments.

Visit a Local Copy Center: Many copy centers, office supply stores, and libraries have scanning services available for a small fee. You can bring your documents to such locations and use their scanning equipment to create digital copies.

Mail: If sending physical copies is an option, you can mail them to us.

Ask for Assistance: From us, we are here to help. If you have a friend, family member, or colleague with access to a scanner, you can request their help in scanning and sending the documents electronically.

Remember to ensure that the quality of the documents you provide is clear and legible, as this is essential for the lender or organization to process your application or request.

Documents can be sent to anesh@lookaftermymortgage.co.uk or to admin@lookaftermymortgage.co.uk

I do not to online banking, what shall I do?

If you do not use online banking and need physical copies of your bank statements, you can take the following steps to obtain them:

Visit Your Bank in Person: You can go to your bank’s local branch and request physical copies of your bank statements. Be prepared to provide identification and your account details to ensure that you are the account holder.

Contact Customer Service: Call your bank’s customer service hotline and inquire about the process for receiving physical statements. They may guide you on the necessary steps or send them to your registered mailing address.

Use an ATM: Some ATMs offer the option to print recent account transactions or statements. Insert your debit or ATM card and select the option to print your statement.

Request Statements by Mail: If visiting the bank in person is inconvenient, you can call the bank and ask if they can mail your statements to your registered address. Confirm that your address on file is up to date.

Set Up Postal Statements: If you prefer to receive paper statements regularly, contact your bank and ask if they offer a postal statement service. This way, you’ll automatically receive physical statements by mail.

Visit a Local Bank Representative: If you have a local banking representative, you can schedule an appointment to discuss your needs, including obtaining physical bank statements.

Remember to verify any associated fees or charges for receiving physical statements, as some banks may charge for this service. Additionally, ensure that your contact information with the bank is accurate and up to date to avoid any delivery issues.

My bank statements are set to 6 monthly, will this be an issue?

If your bank statements are generated every 6 months, it can potentially be an issue when you need more frequent or recent statements for specific purposes, such as applying for a loan, renting a property, or providing financial documentation. In such cases, you might need to take additional steps:

Request Interim Statements: Contact your bank and inquire if they can provide interim statements for the specific months or periods you need. They may be able to generate interim statements or provide transaction history for the required timeframe.

Use Online Banking: Even if you don’t typically use online banking, many banks offer the option to access and download digital statements through their online banking platforms. Consider registering for online banking temporarily to access the statements you need.

Speak to Your Bank: Discuss your situation with your bank’s customer service or visit your local branch. Explain why you need more frequent statements and see if they can offer a solution or alternative documentation.

Plan Ahead: If you anticipate needing more frequent statements in the future for specific purposes, you can proactively request your bank to change your statement frequency to monthly or quarterly, depending on your needs.

Seek Alternative Documentation: If obtaining more frequent statements from your bank is not feasible, inquire with the requesting organization or lender if they accept alternative forms of financial documentation, such as transaction history printouts, certified letters from your bank, or other relevant records.

Remember that the availability of interim statements and the ability to change your statement frequency may vary from one bank to another. It’s essential to communicate with your bank and the organization requesting the statements to find the best solution for your specific situation.

Do you prefer paper documents OR online PDF documents?

Online PDF documents are best for us.

We would only have to scan and rename the paper documents – but this something we would do for you.